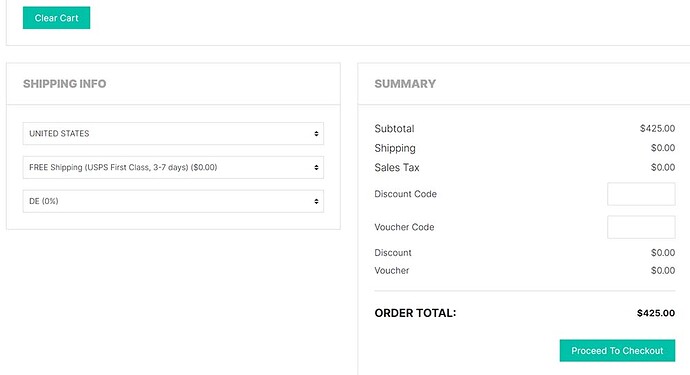

So the sales tax dropdown is on the shopping cart page. The user can choose an incorrect state and check out without paying the proper tax amount. Anyone have a good way to deal with this?

Most ecommerce sites add the sales tax after you enter your address, so it’s automatically based on the proper location.

Hi Liz,

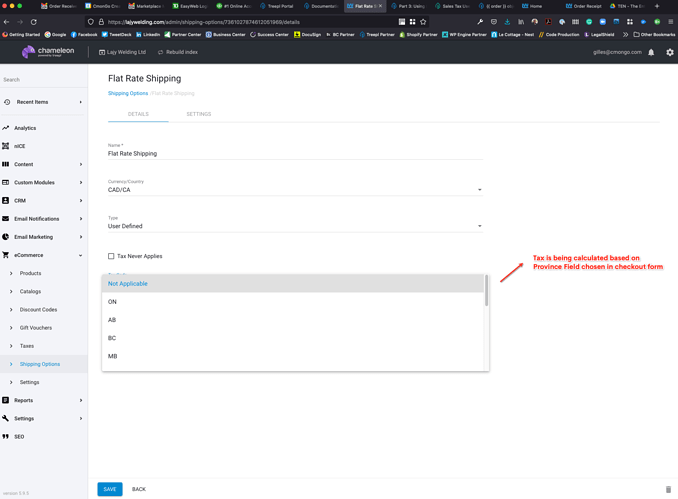

I’ve had the same issue and couldn’t figure it out. (just getting my feet wet really in Coding and Liquid) I had the Treepl Code Production team come up with a solution where (I believe) they pointed the Province/State entered in the shipping address checkout form to the appropriate Tax item so it was seamless to the user and proper taxes are calculated. I don’t know if this points you in the right direction.

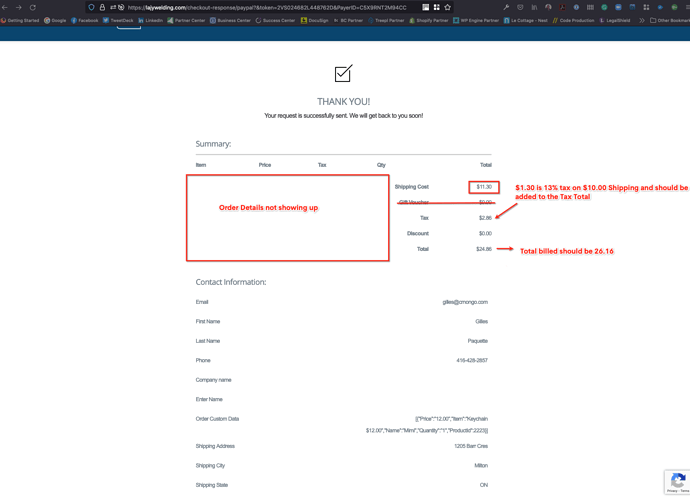

Do you charge tax on shipping in the States? I am having issues getting the tax on shipping to add itself to the grand total that follows through to merchant account (in this case Paypal) Screenshot: https://files.cmongo.com/gaBlUKB I also, in an ideal situation, would like the shipping amount to show without taxes and have $1.30 in this example be part of the Tax Total and flow through to the Total which is does not.

@CmonGo all the available pricing tags (and product information) can be found in the shopping_cart component (before the order is placed), and in the order object (after the order is placed).

You should be able to adjust the Liquid pricing tags to display the various values you are after.

However, I’m not sure how the wrong total could be passed to PayPal and charged without there being an error. Perhaps there is a misconfiguration in the admin regarding when tax is applied to shipping?

Hi Adam,

Thanks for your reply. I have used these two docs, they are fantastic and really helped! The problem is The site functionality was supposed to have been set up by the Treepl Code Production Team based on the selection of the Province field in the Checkout form now embedded within the shopping cart for a 1 step checkout process. (which works fine on the surface adding liquid tags together and such) but the tax on the $10 shipping is not making it through.

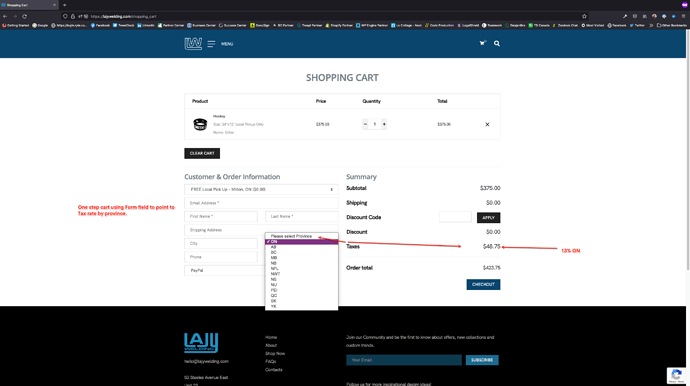

FIGURE 1 - All looks good (but I am currently forced to refresh, the province field should automatically force a refresh of the Tax total)

FIGURE 2 - This shows the incorrect total sent and processed to Paypal.

FIGURE 3 - See screenshot: Screen Shot 2021-09-08 at 1.56.57 PM Tax set to not applicable as amount charge changes based on Province entered under FIGURE 1

Hmmm, not sure sorry.

If Treepl have set up custom tax functionality here it might be best to have them look at what going on.

It’s a bit hard to investigate from this end.

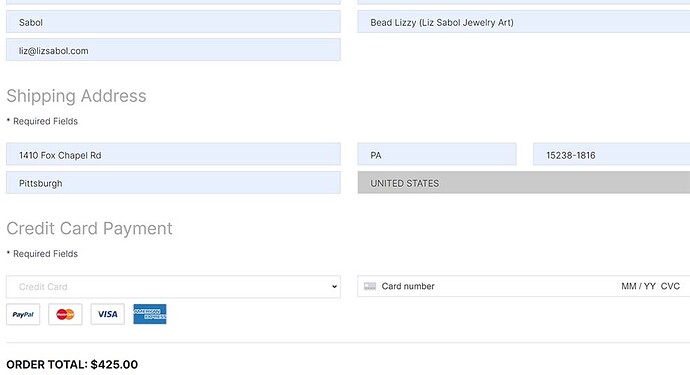

Here is what is going on… The customer can choose a state like DE, that does not collect sales tax.

So $0 tax is added to the total.

But on the checkout page, the customer can enter another state, that I should be collecting tax for.

When you enter a different address on the checkout, it does not update the total.

Here are some screen shots to for example…

Thanks for all the responses!

We had the same issue. The tax selection needs to be embedded into the Form which meant the verification step needs to be in front. The only way was to use cookies to store the data. I’m not much of a back-end developer so I’m not sure if I am explaining this correctly. Others may be able to add more detail. When my team tried to use the database it didn’t work. The Treepl Services Team got it working.

I had to make the cart a one-step cart.

Figure 1

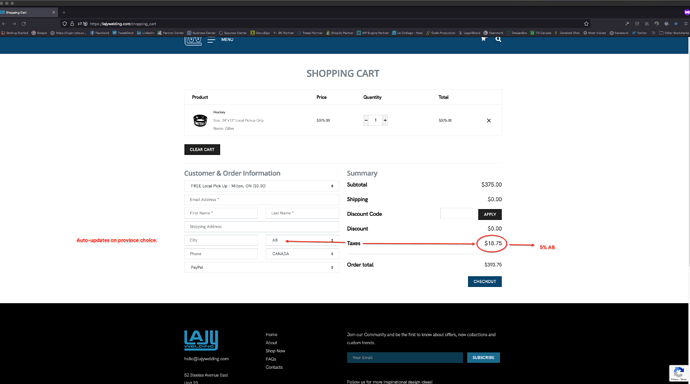

Figure 2